Belarus and sanctions: on a short leash

By providing the russian army with territory to invade Ukraine, Belarusian dictator Alexander Lukashenko made his country an accomplice in war crimes and a target of international sanctions in February 2022.

However, unlike russia, Belarus's economy is not only withstanding the sanctions but also showing remarkable growth. How did this happen, and what lies behind the facade of apparent prosperity?

Life is good, and living is good...

"Sanctions have actually benefited us. We used to work sporadically, so to speak. There were few orders. But now we have full capacity for two work shifts constantly. For the New Year’s, we raffled off iPhones among the staff as bonuses. Previously, our equipment wasn't in high demand; people preferred German products. Now, because of the sanctions, German equipment isn't available, so they buy ours", - said a manager at a Belarusian machinery plant that manufactures equipment for dairy farming.

Statistics indicate that everything is going well in Belarus, not just at one specific enterprise. The country's Gross Domestic Product (GDP) grew by 3.9% in 2023, nearly fully recovering from the decline in the first year of the war. By the end of the current year, authorities forecast further GDP growth of 3.8%. Exports are also showing impressive dynamics.

Export of goods and services from Belarus, billion dollars (according to Belstat and the National Bank of Belarus)

This is despite the fact that traditional trade routes for Belarusian producers have been completely closed: through the Baltic and Ukrainian ports, as well as European markets.

One example is the woodworking industry, one of the main sectors. The EU imposed sanctions on its products in March 2022.

Nevertheless, in 2023, the export of Belarusian sawn timber increased by 37.8%, reaching 955 thousand cubic meters. According to local officials, the primary buyers were Chinese companies.

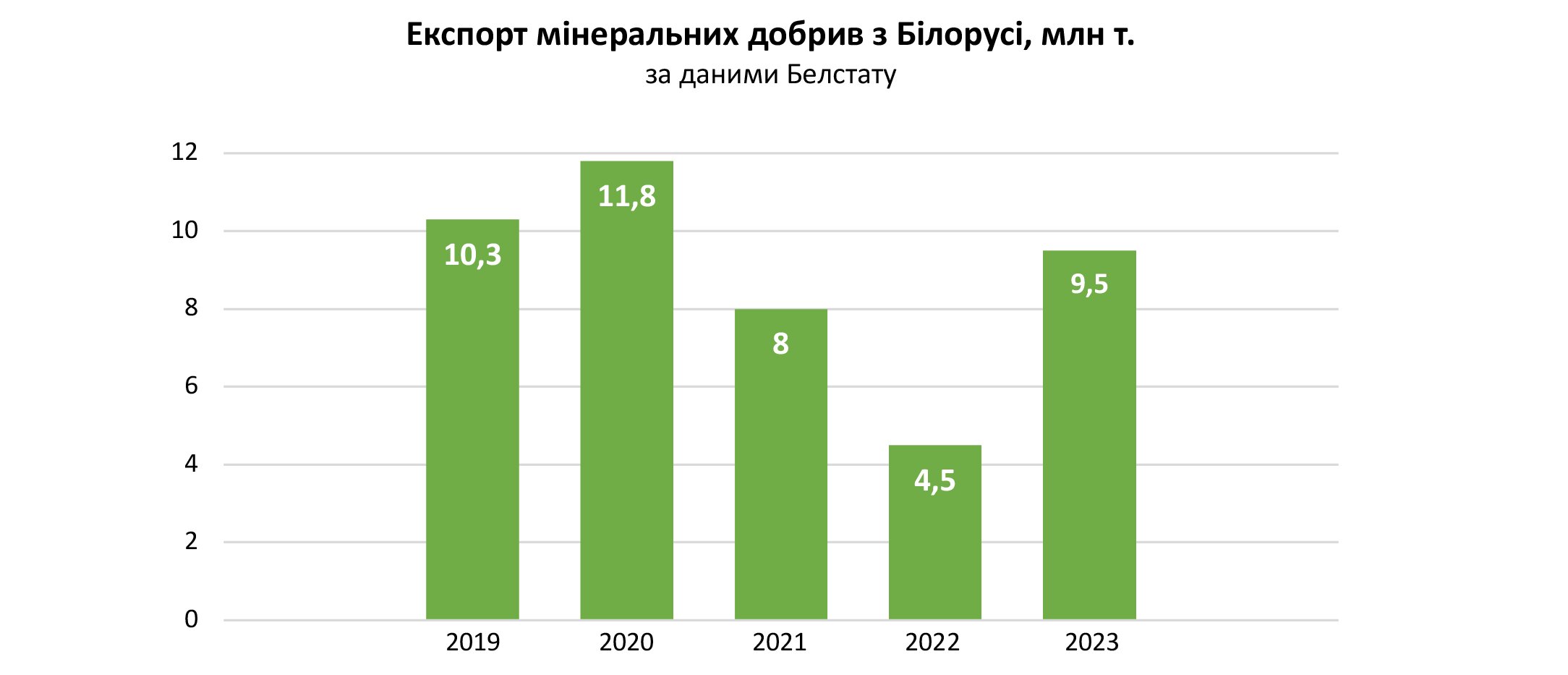

The statistics on the foreign sales of mineral fertilizers, particularly from the "Belaruskalij" association, are also quite telling.

Export of mineral fertilizers from Belarus, million tons (according to Belstat)

The slump in 2022, caused by European sanctions, was completely overcome by the following year. The diagram below of the export routes for Belarusian potash fertilizers in 2023 shows a complete reorientation to eastern markets.

If we look at the dynamics of gasoline and diesel fuel exports, produced by the Mozyr and Novopolotsk oil refineries, it's easy to see that their sales volumes returned to pre-war levels last year.

Based on indirect public data, Belarusian refineries processed about 16 million tons of oil in 2023, with more than 14 million tons coming from russia. Of the resulting petroleum products, 8.5-9 million tons were exported.

According to Belarusian independent experts, "oil refining became one of the key factors for GDP growth in 2023 due to the significant intersectoral effects generated by this sector".

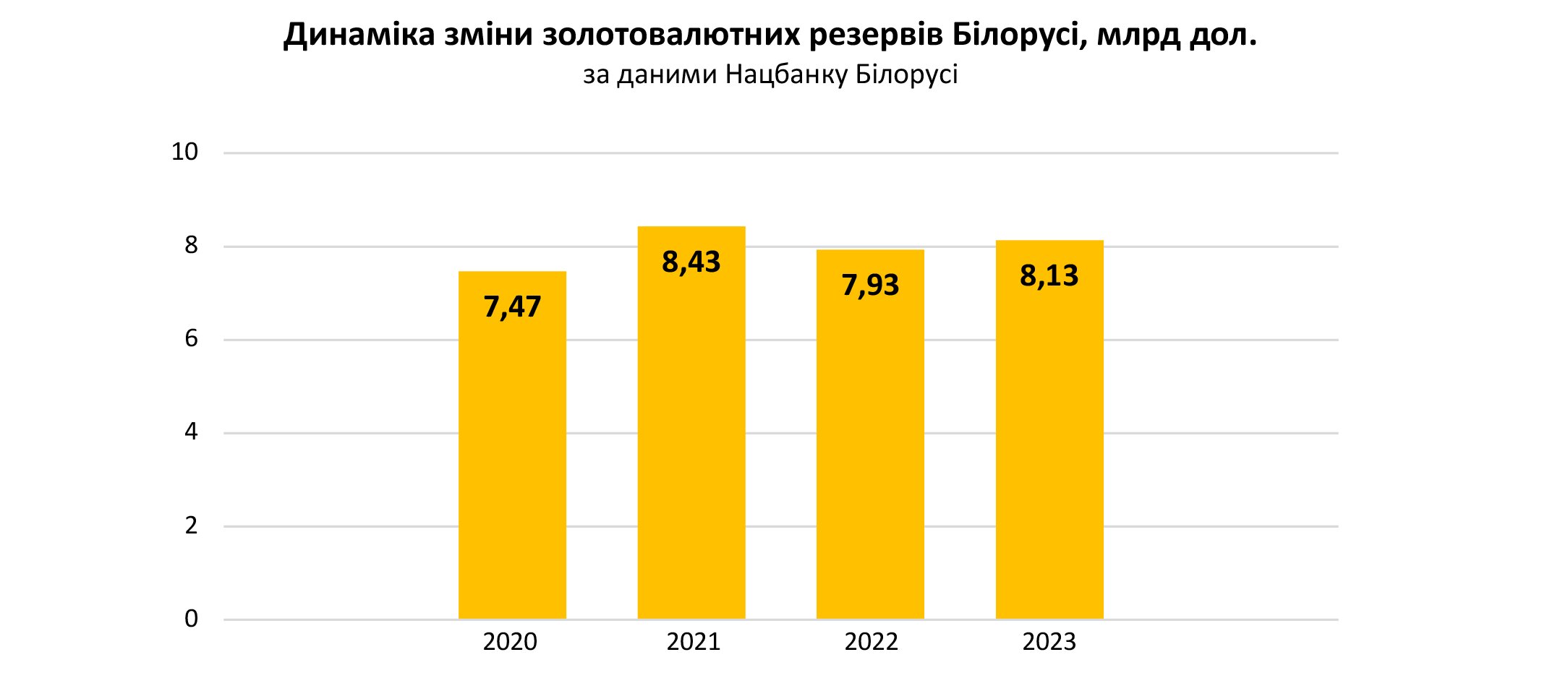

Finally, Belarus's gold and foreign exchange reserves have also returned to pre-war levels.

Dynamics of changes in gold and currency reserves of Belarus, billion dollars (according to the National Bank of Belarus)

The question remains: how did the Belarusian dictator and his government achieve this?

The cost of the matter

The former ambassador of Belarus to russia (now the head of the Presidential Administration of Belarus), Dmitry Krutoy, previously reported that the export of goods to russia amounted to $25 billion in 2023. This means that the russian market absorbed more than half of the foreign sales of Belarusian enterprises. The reorientation to third-country markets was only partial.

Therefore, the Belarusian economy did not "sink" under sanctions solely thanks to the "lifeline" of trade preferences (duty-free import of goods, etc.) thrown from moscow.

However, it should be noted that the russian market is not interested in Belarusian products at all. Potash fertilizers, timber, rolled steel, metal products, gasoline and diesel fuel, food products – russia already has an abundance of these.

Thus, russians have to buy "belarusian" products at the expense of their own producers, who are much more significantly impacted by sanctions. Therefore, the question "How long can the kremlin sponsor the Lukashenko regime through preferential trade conditions?" is far from rhetorical.

Moreover, these "perks" are not the end of the story. Without the Lithuanian, Latvian, Polish, and Ukrainian ports, Belarusian exporters are forced to direct their goods to the northwestern ports of russia (the Leningrad oblast).

This is a longer route to the Baltic Sea and, therefore, more expensive compared to Klaipeda, Ventspils, and Riga. Shipping via this route significantly reduces the profitability of sales for Belarusian enterprises.

To "compensate for the inconvenience" (by order from the kremlin), russian Railways (RR) had to step in. In 2023, this state-owned company provided Belarusian shippers with a discount of 10-40% off the transportation tariff from the Belarusian border to the ports of St. Petersburg.

This translates to, at the very least, lost profit for the RR, and more often, it results in losses. This is because russian railroads have to transport goods from "brotherly Belarus" at almost half the price. These are not trivial amounts, considering that in 2023, the company transported 14.1 million tons of Belarusian cargo to russian ports (of which 6.5 million tons were petroleum products in tanks).

Again, the question arises: how long can such "charity" continue? Obviously, RR cannot sustain losses indefinitely. To compensate for these losses, they have to raise tariffs for their domestic shippers, who are clearly not thrilled with this arrangement.

But Belarusians also pay their price for the "brotherly help" from their neighbor. This price is total (and fatal) economic dependence on russia.

There was a time when, during yet another oil crisis between moscow and Minsk (when russian companies stopped supplying oil to Belarusian refineries) in 2017, Lukashenko publicly instructed his then-prime minister V. Semashko to negotiate the supply of Iranian, Venezuelan, and Azerbaijani oil through Ukraine via the Odesa-Brody pipeline.

"The reduction in oil supplies from the russian federation must be replaced by alternative options. I think the world hasn't narrowed to russian oil", - Lukashenko stated.

And at that time, it worked. As a result, the russian government provided a discount on the price for Belarusian refineries (removing the export duty from this oil). This was because Minsk genuinely had alternative options.

Now, there are none. Therefore, they will have to buy the same oil from russia at the price dictated, even if it turns out to be more expensive than an alternative source (now inaccessible). As for the reorientation of Belarusian exports to third countries, things are not so smooth here either.

Any sanctioned goods are "toxic". Working with a sanctioned counterparty can put the buyer at risk of becoming sanctioned themselves. These risks can only be compensated by super-profits compared to legal deals.

This is why coal from the "DNR"/"LNR" was bought by Turkish companies at 3-4 times below market price, and Chinese and Indian refineries buy russian oil at half the market price. The same situation applies to Belarusian potash fertilizers.

In 2022, when the spot price for potash fertilizers reached $1,200 per ton, "Belaruskalij" was shipping at an average price of $388 per ton, according to the Belarusian Railway Community.

Last year, the situation worsened. Belarusian chemists sold their products for $188 per ton, while the average global market price was $410 per ton. As a result, there was a collapse in export revenue, even though "Belaruskalij" reached pre-war levels in terms of volume. This leads to a situation where it seems like, "Stop selling, or there won't be any change left to give".

Export of mineral fertilizers from Belarus, billion dollars (according to Belstat)

This is confirmed by foreign trade statistics for 2024, which significantly worsened in the first quarter compared to the same period last year.

The decrease in the positive trade balance with the CIS (i.e. russia) confirms the first assumption: that "brotherly help" cannot indefinitely keep Belarusian trade in the positive.

The negative balance in trade with distant foreign countries (outside the CIS) confirms the second assumption: sanctioned trade at rock-bottom prices results in having "no change left to give".

Returning to the topic of last year's growth in Belarus's GDP, experts from the BEROC research center explain it as the "use of Soviet practices in economic management". These practices do have an effect, but the problem is that it’s a short-term one.

What does this mean? For example, you can find videos online showing A. Lukashenko arriving unexpectedly at a farm and berating the local farm and district management over unwashed cows. It's absolutely clear that if it takes a personal visit from the country's president to get the cows cleaned up, then things are very bad for this farm in particular and the economic system as a whole.

The president comes and goes, but the cows and workers remain the same. The workers have the same attitude towards their work, and the cows, consequently, stay in the same condition. The economy can't progress far on such "Soviet practices".

This is why independent Belarusian economists and their foreign colleagues are skeptical about the government's plans for GDP growth of 3.8% this year. BEROC believes it will be only 1.6%, and according to the World Bank, 0.8%.

By Vitaliy Krymov, OstroV